Cast your mind back to June 2017. The birds sang, the sun shone and Google received a record-breaking fine of €2.4 billion ($2.8 billion).

Cast your mind back to June 2017. The birds sang, the sun shone and Google received a record-breaking fine of €2.4 billion ($2.8 billion).

But why, exactly? In a verdict that provoked differing opinions, European Union (EU) regulators ruled when it came to its search results pages, Google favored its own search results over other comparison shopping services (CSS). Comparison shopping services such as Kelkoo or Shopzilla operate by aggregating online retailers’ product offers.

Originally the search engine giant limited comparison shopping services to showing text ads only. Following their complaints, however, Google made it technically possible for them to show product ads. But this changed nothing for the CSS providers, as retailers saw no benefit in an additional intermediary. Further pressure followed, culminating in the eye-raising penalty and an antitrust order that Alphabet’s subsidiary do more to even things up.

The Shopping platform is big business for Google. Top retailers pump huge amounts of money into the format, more than they do on text ads.

Image source: crealytics.com

Faced with the risk of further penalties, including the shutdown of its Shopping service altogether, Google needed a quick response. Twelve months later, the solution looks bright for EU retailers, Google now offers discounted rates to retailers that use its new Comparison Shopping program.

Provided they work with a registered CSS partner, accounts can enjoy cost per clicks (CPCs) up to 20 percent lower than regular Shopping auctions. Additionally, Google will offer any certified CSS partner a monthly rebate (referred to as “SpendMatch”) of up to $37,400.

A kickback stampede

Google’s ploy to give comparison shopping service providers more market share has triggered a stampede, with all kinds of service providers clambering to gain CSS status.

From what we’ve seen, experience levels and resources vary; providers only need to create a website with a few product feeds to participate. The search engine does all the heavy lifting (e.g. query/product match).

We’ve noticed dozens of new CSS providers popping up recently. This underlines one of Google’s major arguments against the European Commission — comparison shopping providers have very thin value in this game. For this reason – and after seeing what’s now happening in the market — I don’t believe the ruling makes much sense.

CSS partnerships

Google’s new scheme includes one, small visual update. Comparison shopping service generated ads are self-titled. It’s worth pointing out those who click on the ad itself arrive directly on the retailer’s site; the less than 1 percent of shoppers who click on the “By X” land on the CSS website.

The ads only show as product listing ads (PLAs) in the search engine results page (SERP), not on the Shopping tab.

It’s a simple process for retailers, who mirror their shopping campaigns in a separate CSS account. They allocate a smaller part of their budget to their regular accounts (which largely show ads within the shopping tab) and spend the bulk within the CSS account to capitalize on the lower CPCs and additional incentives.

Too good to be true?

As with any get rich quick scheme, if you only chase big rewards you may fail to see big risks. Google Shopping suffers from a big problem: scarce data. Most products lack adequate historical information to ensure the right bidding decisions.

It’s a slippery slope. Buoyed by a kickback windfall, retailers split their data more and more thinly so both CSS’s and regular campaigns end up with just a fraction of information to work with. A chaotic, myopic process ensues. No one knows how their competitors have behaved. Even if CSS and regular campaigns are managed by the same party, without careful alignment of bids, companies compete against themselves.

Bids for the CSS and the regular campaign are based on just a small bit of data, whoever bids highest, wins. Realizing they were trumped by a rival, the losers raise their bids in response. Quite often this decision isn’t made intentionally but unconsciously, by bidding tools which can’t see the big picture. In almost every conceivable case, a bidding war begins.

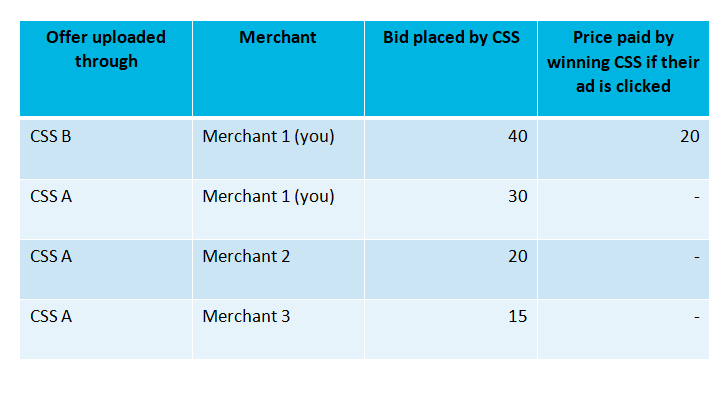

As far as Google is concerned, it’s a democracy. Only one ad can be served for a specific stock keeping unit (SKU) and a specific retailer; it doesn’t matter how many comparison shopping services participate in the auction. Theoretically, all may bid to serve an ad on behalf of the same retailer and enjoy an equal chance of making it to the SERPS.

According to Google’s school of thought, the program’s structure keeps CPCs down for retailers. Theoretically, none of the parties placing bids on behalf of the retailer determine the CPC in the second-price auction.

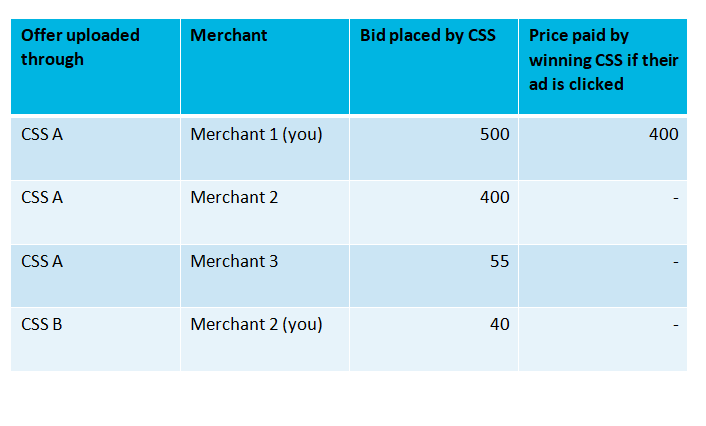

This may describe the auction design correctly. But it proves the exception rather than the rule and hides the big downsides to almost any other realistic example. In practice, auctions see huge diversity. Parties working on your behalf will place a wide range of bids. Competitors who don’t work on behalf of the retailer will determine the CPC in the auctions.

In the example below, CSS B is still placing the same bid as in the previous example. However, Merchant 1 will now pay 400 per click – 20 times higher than before – all because CSS A placed a very aggressive bid.

Getting it right

How can retailers navigate these challenges? The secret lies in their choice of provider. Getting it right means aligning all available data, and this can only be achieved when a single party manages both their standard Shopping and CSS accounts. You either let your CSS provider manage both the regular campaigns as well as the CSS campaigns, or you let your agency manage both if they have a CSS offering.

In normal circumstances, a partner manages campaigns by using partial data at the account-level. A successful CSS program requires the partner to aggregate product-level data across multiple accounts (the regular direct accounts as well as one or multiple CSS accounts). With the right technology in place, their bidding algorithm should be able to operate on cohesive – not siloed – data.

At Crealytics (my company), we built a custom comparison shopping service bidding solution for this purpose. It calculates a single bid per SKU, based on all available data and across different accounts. This allows retailers to maximize the kickback while avoiding CPC inflation. Retailers who ignore these points risk overshadowing any kickback-related gains.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.