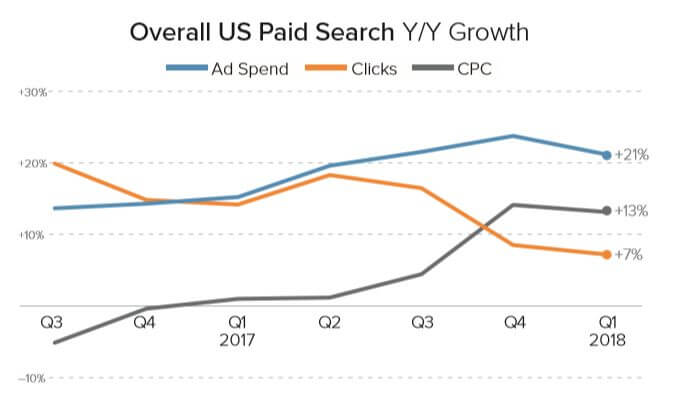

Shopping campaigns on Google and Bing continued to fuel paid search spend in Q1 2018, according to digital agency Merkle’s latest quarterly report. Overall, search spend increased 21 percent year over year among the sample of Merkle clients’ US campaigns included in the report [registration required].

Looking at overall performance, cost-per-click (CPC) growth remained relatively steady from Q4 2017, increasing 13 percent year over year. That CPC growth is much higher than what Merkle clients, who skew large retailer, experienced in the earlier quarters of 2017. The rising CPCs have coincided with improved ad quality and higher conversion rates. Click volume growth has slowed significantly over the past two quarters, up 7 percent year over year in Q1 2018.

Source: Merkle Q1 2018 Digital Marketing Report

Merkle clients spent 20 percent more on Google paid search in Q1 2018, on average, than the previous year, marking the fifth straight quarter to see year-over-year spend growth surpass 20 percent. Click volume was up 7 percent, and CPCs increased by 13 percent year over year. Merkle says average CPCs have risen sharply across formats and devices, but that brand keyword text ads have seen the biggest CPC jumps.

Google Shopping grows across all formats

Google Shopping spend shot up 40 percent year over year. That’s the highest rate of growth Merkle has recorded in nearly two years.

Shopping ad impressions increased by 47 percent year over year, and average non-brand CPCs on product listing ads rose 15 percent.

Overall, product listing ads (PLAs) generated 60 percent of retailers’ Google search ad clicks. The increase from 55 percent click share in Q4 2017 represents the biggest quarter-over-quarter jump in more than four years, says Merkle. Non-brand PLA clicks also jumped in Q1, to 82 percent of retailers’ clicks.

Local Inventory Ads (LIA) click share also continues to rise for those participating in the program. On desktop, LIA generated 7 percent of clicks, up from just 1 percent a year ago. Mobile LIA clicks accounted for 15 percent of clicks, up slightly from 14 percent the previous year.

Click share for Showcase Shopping Ads represented 2.7 percent of mobile Google Shopping ad clicks, up from just 1.3 the previous quarter. On tablet, Showcase Shopping Ads drove 3.8 percent of Shopping clicks, up from 1.9 percent in Q4 2018.

Text ads: CPC growth coming in part from top ad positions gaining click share

Spending on text ads slumped to just 4 percent growth in Q1 2018, down from a steady increase of around 15 percent in the prior three quarters. Most advertisers saw text ad impressions fall or stay flat year over year. Non-brand CPCs on text ads rose 7 percent on average.

Meanwhile, brand CPC growth on Google remained high from the previous quarter after seeing negative growth for most of 2017. Average brand CPCs increased by 28 percent year over year, up from 23 percent in Q4 2017. Merkle says it has seen nothing in Google Auction Insights reports to indicate that higher CPCs have been caused by increased competition. The declines in brand CPCs seen last year possibly reflect Google’s changes to Ad Rank thresholds.

Merkle has also observed declining click share for ads in the third and fourth positions at the top of the search results. “These lower position ads had helped depress CPC growth, so as their contribution to clicks has decreased, it has helped drive CPCs higher,” writes Mark Ballard, Merkle director of research, who leads the report.

Customer Match & Similar Audiences have minimal impact on click volume

Looking at the use of audience targeting in AdWords campaigns, overall, audience targeted campaigns accounted for 34 percent of Google Search click share in Q1. The overall increase in click share reflects the steady rising trend of click share for RLSAs (remarketing lists for search ads). Customer Match and Similar Audiences account for just 3 percent click share each, and that has remained steady for several quarters.

Source: Merkle Q1 2018 Digital Marketing Report

Bing & Yahoo

Search ad spend across Bing Ads and Yahoo Gemini (combined in this report) saw robust growth again in Q1, increasing 30 percent year over year. Clicks increased 11 percent and CPCs continued to rise, with 17 percent growth compared to a year ago.

Bing Product Ads gain click share

Bing Product Ad spend continues to drive upward, increasing 64 percent year over year. Product Ad spend increased nearly 700 percent on phones and 41 percent on desktop. Click volume on Bing Product Ads increased 110 percent year over year. Overall, Product Ads click share hit 33 percent, and Product Ads now account for more than 50 percent of retailers’ non-brand clicks.

Text ad spend on Bing and Yahoo increased 24 percent in Q1 2018.

Mobile keeps gaining click share

Phones drove 55 percent of Google clicks, 26 percent of Yahoo Gemini and 18 of Bing Ads search ad clicks. That’s a five-point increase for Bing Ads from last quarter, driven by mobile Product Ad clicks, says Merkle.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.