Prime Day is now Amazon’s largest sales day of the year, growing more than 60 percent YoY and surpassing last year’s Black Friday and Cyber Monday, according to Amazon’s numbers. With so much shopping activity, many retailers now see ripple effects across different marketing channels stemming from Amazon’s big sales day, which was held on July 11 this year.

This is certainly true of paid search, where retail brands (somewhat surprisingly) saw stronger conversion rates on Prime Day, and less meaningful shifts, such as bumps in search partner impression share. Here, we’ll dive into advertiser performance and what it means for Prime Day expectations moving forward.

Phone non-brand conversion rate spikes around Prime Day

Looking at non-brand text ads, phone conversion rate spiked significantly on Prime Day. Desktop and tablet conversion rates were relatively strong on Prime Day, though they didn’t significantly outpace the rest of July in the same way phone conversion rates did.

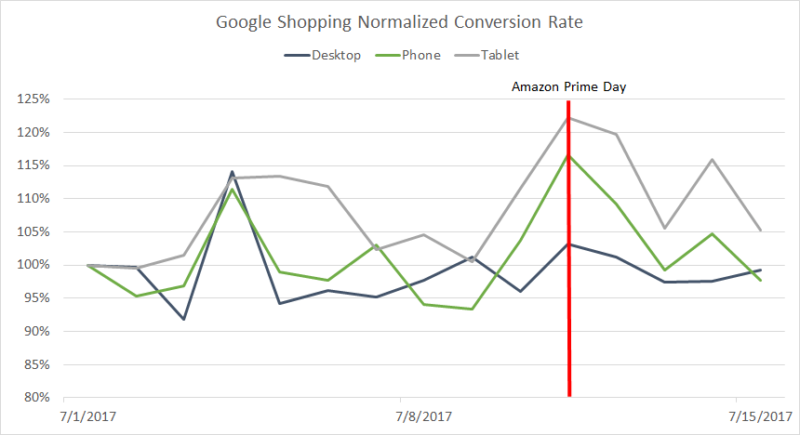

Similarly, Prime Day Google Shopping conversion rate also spiked on phones. Tablet conversion rate also spiked, while there was little movement in desktop Google Shopping conversion rate.

As such, it appears that Amazon Prime Day and the online retail interest it generated had a positive impact on the likelihood that non-brand searchers would convert after clicking on an ad.

However, it also appears that Prime Day phone converters were primarily interested in getting good deals and/or making smaller purchases, as phone average order value (AOV) for non-brand text ads was far lower on Prime Day than on any other day so far in July. No such decline was observed on desktop.

For the most part, the advertisers studied did not significantly discount products on Prime Day, indicating the drop in AOV was more the result of user behavior as opposed to advertiser actions taken to compete with Amazon on its big day.

With an increase in conversion rate and a decrease in AOV, non-brand sales per click remained roughly the same on Prime Day as during the rest of July. Thus, even though searchers are more likely to convert, advertisers may not need to bid more for non-brand text ad traffic if they’re shooting for a return on ad spend goal. Still, brands should assess how sales per click moved at the keyword level to determine if some terms might warrant higher bids next Prime Day.

On the Google Shopping side, phone AOV was slightly lower on Prime Day than earlier in July, but the conversion rate increase was enough to increase overall sales per click relative to the days immediately preceding and following Prime Day.

Aside from conversion rate and average order value, advertisers also saw shifts in impressions coming from the Google search partner network.

Increased Amazon site visits drive up search partner impressions

Amazon is still a Google search partner for text ads and features AdWords-powered numbered links on its site.

This means that the spike in Amazon visits that accompanies Prime Day ends up driving up the impression share advertisers get from the search partner network across all three device types.

Despite the increase in impressions, the search partner network accounted for roughly the same share of clicks across device types during Prime Day.

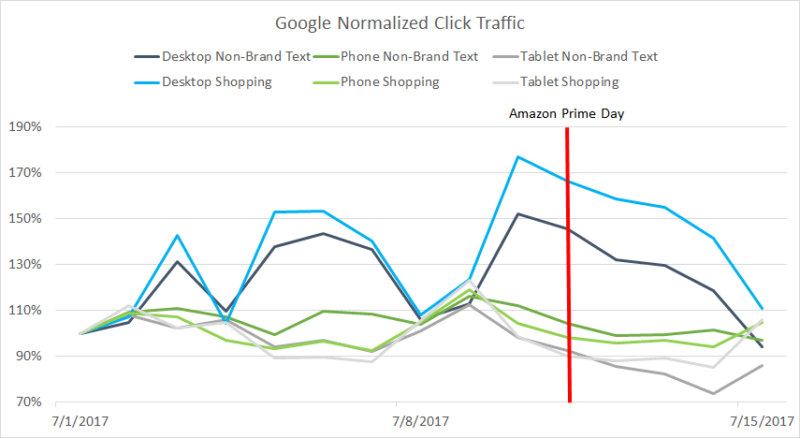

Across google.com and the search partner network, Google paid search clicks only seemed to rise on desktop devices for both non-brand text ads and Google Shopping, though these increases began the day before Prime Day.

It should be noted that there are day-of-week trends at play, as well as the effects of the Independence Day holiday the week before. But overall, this graph indicates that search traffic held relatively steady on Prime Day for phones and tablets and seemed to increase moderately on desktop the day before and on Prime Day.

Conclusion

Amazon Prime Day continues to steadily grow as an e-commerce “holiday,” and its effect on online retail is likewise growing in influence.

In paid search, users appear more willing to convert on mobile devices after clicking through ads, though Amazon’s heavy discounts also seem to steer users toward smaller cart sizes even when they’re not on the Amazon domain.

As always, different advertisers should expect different effects from Prime Day in the future, and many brands saw trends that don’t line up with what was seen in aggregate this year. Even different keywords within an account are impacted differently by the surge in e-commerce demand.

Thus, it’s important for paid search marketers to dig into each account’s performance to assess whether there should be any updates to bidding or ad copy next year for Prime Day. It’s clear that Amazon’s sale is big enough to impact retailers across a wide array of industries, and brands must in turn be ready to optimize for those effects as best they can.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.