Tis’ the season to send our current year packing with a swift kick and start the new year off on a high note. And brands that are doing precisely that this holiday season are arming their teams with the most accurate, real-time consumer research possible. Let’s see how that looks and ways your brand can still take advantage of opportunities that consumer research has to offer this holiday season.

The state of holiday gifting

The state of holiday gifting in 2021 is rife with unprecedented shifts in consumer and market behaviors that have yet to settle from the pandemic. This is partly because we’re still in the midst of some scary situations, but it’s primarily because consumers have permanently shifted their purchase behaviors in a whole host of ways.

As we examine more in-depth in our Consumer and Market Intelligence Report: Holiday Gifting 2021, retailers should fold easily identifiable consumer behaviors into their strategic planning this holiday shopping season – and move these same concepts forward into 2022.

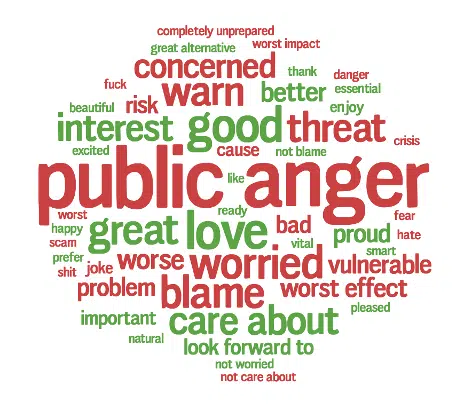

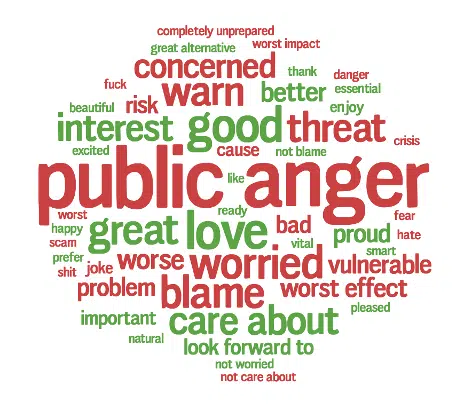

For starters, the overwhelming sentiment around sustainability matters is fairly negative – and this concept weighs heavily on the minds of consumers this season. Consumers have increasingly held brands to a socially aware bar, which has certainly affected their purchase decisions. And with the timing of our global environmental summits coming at the height of the holiday buying season, there’s a general sense of anger around the topic.

This is definitely something that retailers should be following closely – but it’s far from the only top-of-mind concern. The key guidance for brands this season is to remain flexible and allow data to drive decision-making and pivots in positioning, as there will likely be many shifts in the coming weeks. Spending is on the rise in many segments, after all, but capturing any part of it will require understanding the intersection of consumer values and purchase behaviors as cost-conscious consumers make hesitant steps toward your products. Retailers must map out relevant and meaningful tactics to entice hesitant consumers.

And there are challenges that further complicate the season, including supply chain concerns, labor shortages and waning consumer loyalties from those whom brands thought they’d already won over. We’ll look at each a bit further here, as well as some top gifts we see consumers clamoring for online. And we’ll share some changes that retailers can make to capture a sizable piece of anticipated profits during this emotionally charged shopping season!

Supply chain challenges and labor shortages

Consumers expect unprecedented out-of-stock messages from retailers and have started their holiday shopping early to ensure timely delivery. But they know that even that may not be enough, with nearly 40% of small businesses in the US experiencing supply chain delays during the Coronavirus pandemic. Contrast this with eMarketer forecasting US retail sales during the holiday shopping season to surge 9% to $1.147 trillion, with e-commerce accounting for 18.4% of total retail sales, and you have a recipe for extreme disappointment.

As a result, because they can’t meet demand right now, many retailers are holding back on shopping deals this year. And even those retailers secure in their inventory numbers are dealing with their own unique challenges as many do not have sufficient workers to run their stores and meet consumer demand in that way. Workers who are showing up are quitting in higher numbers, too, due to stress and subpar wages. And this also ties into the shift in consumer spending, as it speaks to value-based spending as much as sustainability concerns do!

Consumer purchase behaviors shifting

The 2020 holiday gifting season set everyone on edge due to its pandemic-induced unpredictability – and waning consumer loyalty added to the troubles.

And as we charge into 2021’s prime gift-getting period, retailers turn a wary eye toward their prospects, with those looming labor and inventory shortages. As mentioned at the outset, thanks to the timing of our global environmental summits and the general sense of anger around the topic, sustainability benchmarks are something that retailers should be prepared to message out.

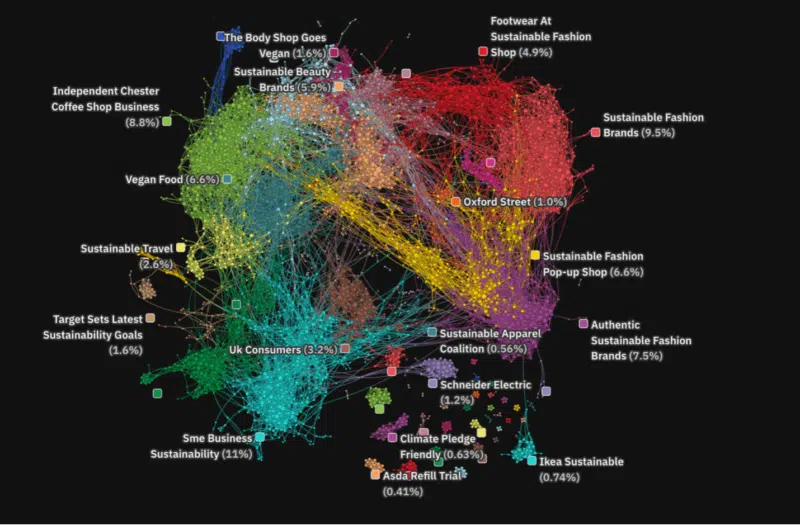

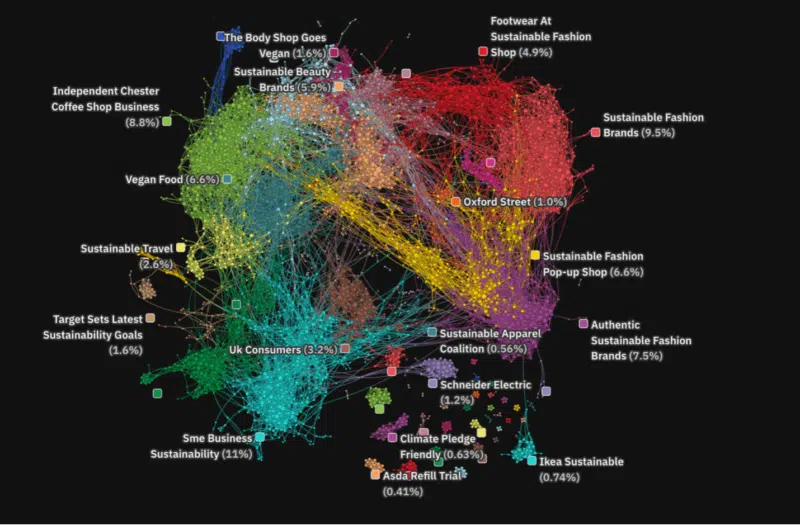

To put a finer point on things, as the visualization below communicates, consumers seek sustainability in fashion, footwear, food and travel. You can be sure consumers are seeking the same from you even if your category isn’t mentioned below or in the news right now. You’ll have your moment when you’re not ready for it – so be ready for it!

Consumers are no longer loyal to particular brands, as e-commerce has opened up an entirely new world of shopping for many of them.

And, as hinted to in our section about labor shortages, consumers are noticing those as well – and they’re not impressed. Retailers who pay workers what people consider subpar wages are being increasingly shunned by an extremely observant consumer base. Their loyalties trend toward shopping small and supporting a more entrepreneurial spirit, with DIY shops cleaning up this season.

With inventory, workers and consumer metrics all in disarray to varying extents, it has been more important than ever for brands to keep close tabs on consumer research to take the temperature of their virtual showrooms and understand which components require immediate attention first.

Brands that are getting this right are not only surviving but thriving as consumers share their purchases and purchase intent with others on social media, forums, blogs and news sites. It’s an incredibly viral and lucrative way to promote one’s products, assuming you’re in touch with your audience and know who to call on to help you get the word out!

Top gifts consumers crave

The trick for retailers will be pivoting towards those unclaimed dollars by creating precisely what their consumers crave. And this requires understanding purchasing behaviors and values and where these elements intersect on the customer journey.

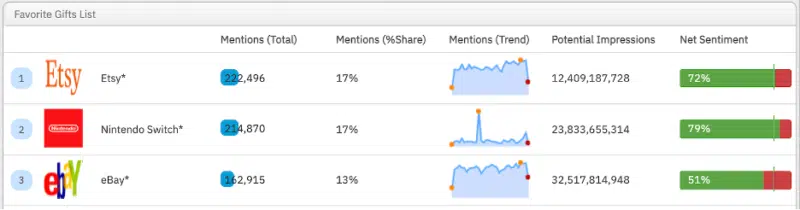

As we explored the holiday shopping landscape, we found a variety of top gifts capturing consumer attention – our top three (out of a list of 15) are shown below.

As noted above, the categories winning market share support shopping small, DIY, sustainability (by way of upcycling others’ second-hand items) and then an ever-present push toward technology. More specifically, we see gaming taking over across many consumer segments.

Brands finalizing their overall planning to round out Q4 and set the stage for 2022 need to be sure to keep what we’ve detailed above in mind. Consumers are watching and your time to connect with them and create long-term relationships is now. There are consumer segments that are spending lots of money this year, and if they’re not spending with you, it’s time to figure out why. Analyzing consumer research relevant to your specific category is a gift that you can give yourself – and one that will keep on giving throughout next year!