Google’s traffic acquisition costs (TAC) have been climbing. As Google’s ad revenues grow, so does the money it pays to partners and distributors. Investors are particularly sensitive to this issue.

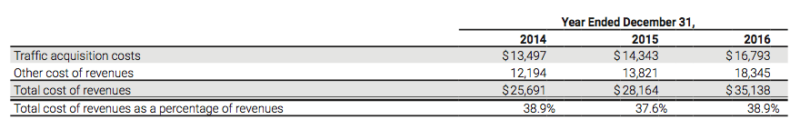

In response to investor questions, Alphabet CFO Ruth Porat explained recently that Google’s increasing traffic costs are partly about mobile and programmatic growth, which have different payment structures and higher TAC. Last year, Google’s ad revenues were $90.3 billion; its TAC was $16.8 billion (other cost of revenues was $18.3 billion).

Alphabet cost of revenues, including TAC

Source: Google 10K filing 2016

As Bloomberg reports, investors worry that increasing TAC will squeeze margins and make Google less profitable. In Alphabet’s 10K filing from 2016, the company said the following about rising TAC:

Financial analyst Mark Mahaney recently estimated, according to Bloomberg, that each percentage point of TAC growth for Google/Alphabet represents nearly $300 million in decreased profit. In 2016, TAC as a percentage of Google advertising revenues was 21 percent; as of Q2 2017, it was 22 percent.

In the past, however, TAC has been higher as a percentage of overall revenues. In 2010, it was 26 percent of ad revenues, and in 2009, it was 27 percent. Yet Google’s ad revenues are much higher now, and so are the real dollars it pays to partners.

TAC has been increasing partly because of these distribution and rev share payments, which Google makes to Apple and various Android ecosystem partners. It has been estimated they will approach $10 billion by year-end, up from roughly $3.5 billion five years ago.

Another wild card that could impact TAC, according to Bloomberg, is regulation. In its 10K filing late last year, Google said new litigation or regulations, including the elimination of various safe harbors, could impact Google’s performance and increase costs:

- The General Data Protection Regulation (GDPR), coming into effect in Europe in May of 2018, creates a range of new compliance obligations and increases financial penalties for noncompliance significantly.

- Court decisions, such as the “right to be forgotten” ruling issued by the European court, which allows individuals to demand that Google remove search results about them in certain instances, may limit the content we can show to our users and impose significant operational burdens.

- Various US and international laws restrict the distribution of materials considered harmful to children and impose additional restrictions on the ability of online services to collect information from minors.

- Data protection laws passed by many states and by certain countries outside the US require notification to users when there is a security breach for personal data, such as California’s Information Practices Act.

- Data localization laws generally mandate that certain types of data collected in a particular country be stored and/or processed within that country.

According to Reuters, the UK government is considering removing one of Google’s safe harbors. It’s contemplating regulating Google and Facebook as traditional news publishers, with all the associated burdens and potential liabilities. An increasing percentage of the population gets its news from these sources, even though they’re not the generators of the news.

Partly this is a response to a number of traditional publishers and media outlets which are lobbying UK regulators to treat Google and Facebook as they’re treated. That would almost certainly increase Google’s operational and legal costs as well.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.